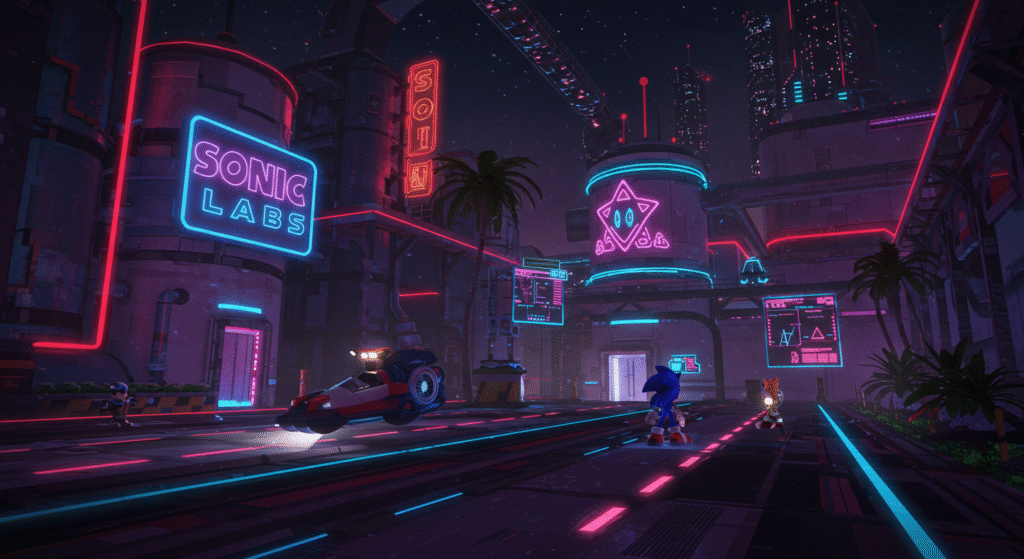

Sonic Labs has emerged as a significant player in the blockchain space, carving out a niche as a high-performance, EVM-compatible Layer-1 (L1) blockchain. This article delves into the history of Sonic Labs, its journey to becoming a leading contender for the fastest EVM L1, and the future potential and utility of the platform.

From Fantom to Sonic Labs

Sonic Labs is not an entirely new entity but rather an evolution of the Fantom Foundation. Fantom, launched in 2018, utilized a Directed Acyclic Graph (DAG) technology and the Fantom Opera network to support smart contracts. While Fantom’s technology offered scalability advantages, Sonic Labs represents a strategic pivot towards next-generation Layer-1 blockchain innovation.

The rebranding to Sonic Labs was accompanied by the development of a new blockchain network, “Sonic,” and its native token, $S. This transition signifies a commitment to building a robust infrastructure for decentralized finance (DeFi) and providing developers with the tools and incentives to create cutting-edge applications.

The Journey to High Performance

Sonic Labs aims to address some of the key limitations of existing blockchain networks, particularly in terms of speed, scalability, and cost-efficiency. Sonic employs a Proof-of-Stake (PoS) consensus mechanism and a novel architecture to achieve:

- High Transaction Speed: Sonic boasts the capability to process a high volume of transactions per second (TPS), significantly surpassing the capabilities of many other L1 blockchains.

- Sub-Second Finality: Transactions on Sonic are confirmed rapidly, providing users with a near-instant experience.

- EVM Compatibility: Sonic is fully compatible with the Ethereum Virtual Machine (EVM), allowing developers to easily deploy existing Ethereum-based applications without significant code modifications.

- Reduced Costs: Sonic aims to lower the costs associated with running nodes and executing transactions, making it more accessible for both developers and users.

Key technological innovations that contribute to Sonic’s performance include:

- Sonic Virtual Machine (SonicVM): An optimized virtual machine designed to execute smart contracts more efficiently.

- Sonic Database (SonicDB): A new database solution that enhances data management and storage.

- Sonic Gateway: A decentralized bridge that facilitates seamless asset transfers between Sonic and Ethereum, enhancing interoperability and liquidity.

Incentivizing Developers and Growth

Sonic Labs recognizes the importance of a thriving developer ecosystem for the long-term success of any blockchain platform. To attract and retain developers, Sonic Labs has implemented several key initiatives:

- Fee Monetization: Sonic enables developers to earn a significant portion (up to 90%) of the transaction fees generated by their applications. This incentivizes the creation of high-quality, user-centric dApps.

- Innovator Fund: Sonic Labs has allocated substantial funding to support developers, startups, and projects building on the Sonic network. This fund aims to foster innovation and drive the growth of the Sonic ecosystem.

- Airdrops: The platform has also employed airdrops of its native token, $S, to incentivize both users and developers to participate in the Sonic network.

The Future of Sonic Labs

Sonic Labs has the potential to become a leading Layer-1 blockchain platform, particularly for DeFi applications. Its high performance, EVM compatibility, and developer-friendly incentives position it to attract a growing number of users and developers.

The platform’s focus on speed and scalability could enable the development of new and innovative dApps that were previously infeasible on slower blockchain networks. Additionally, the emphasis on decentralization and security could make Sonic a more robust and reliable platform for the future of Web3.

However, like any emerging technology, Sonic Labs faces challenges. Adoption, network effects, and competition from other L1 and Layer-2 solutions will all play a role in its long-term success.